India's Sovereign Green Bonds: Paving the Path to a Greener Future

As a part of the government’s overall market borrowings in 2022-23, sovereign Green Bonds will be issued for mobilizing resources for green infrastructure. The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy.

In Brief

- India’s transition towards a greener future accelerates with the issuance of its first sovereign green bonds.

- A well-structured green bond framework boosts investor confidence and funds environmentally beneficial projects aligned with climate goals.

- The resounding success of India’s debut green bonds sets the stage for a sustainable economy and larger upcoming issuances.

India’s transition towards a greener and more sustainable future took a significant stride in January with the issuance of its first pair of sovereign green bonds. This move comes as part of the country’s ambitious decarbonization goals, aimed at reducing greenhouse gas emissions and embracing cleaner energy sources. Let’s explore how India’s green bonds are set to play a vital role in financing its path to decarbonization.

Building the Foundation:

Before the issuance of green bonds, India laid the groundwork by releasing a comprehensive green bond framework in November 2022. This framework ensures transparency and credibility in the green bond market, giving investors confidence and reducing the risk of greenwashing – the practice of making deceptive environmental claims.

The framework, while not legally binding, aligns with the International Capital Markets Association’s Green Bond Principles (GBP), which serve as guidelines for green bond issuances worldwide. The initial effort in establishing the framework may have been substantial, but it sets the stage for smoother and more efficient future issuances.

Core Components of India’s Green Bond Framework

Use of Proceeds:

- The proceeds of sovereign green bonds can be used to finance projects in nine eligible categories: renewable energy, energy efficiency, clean transportation, climate change adaptation, sustainable water and waste management, pollution prevention, conservation and restoration of natural resources, sustainable agriculture, and other climate mitigation and adaptation projects.

- The projects must have a positive environmental impact and must be aligned with the government’s climate change goals.

- The proceeds of the bonds must be used for their intended purpose and must be tracked and reported on.

Process for Project Evaluation and Selection:

- The government will establish a Green Finance Working Committee (GFWC) to oversee the sovereign green bond program.

- The GFWC will be responsible for evaluating and selecting projects for financing with sovereign green bond proceeds.

- The GFWC will use a set of criteria to evaluate projects, including the environmental impact of the projects, the alignment of the projects with the government’s climate change goals, and the financial viability of the projects.

Management of Proceeds:

- The proceeds of sovereign green bonds will be managed by the National Investment and Infrastructure Fund (NIIF).

- The NIIF will be responsible for investing the proceeds in eligible projects.

- The NIIF will report to the GFWC on the use of proceeds and the environmental impact of the projects.

Reporting:

- Issuers of sovereign green bonds will be required to provide annual reports on the use of proceeds and the environmental impact of the projects.

- The reports will be made public and will be available on the website of the Ministry of Finance.

A Resounding Success:

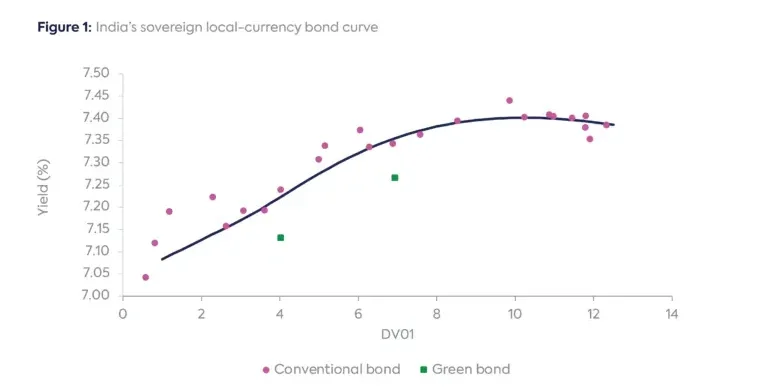

India’s debut green bonds were a resounding success, both in terms of the premium they fetched and their issuance in the local currency. The Ministry of Finance raised $1 billion initially, which doubled to $2 billion following a second sale in February, with an estimated premium of 5-6 basis points each. In the secondary market, the average premium for the two bonds stood at 9 basis points, in line with emerging market sovereign and quasi-sovereign green bonds. By issuing the bonds in Indian rupees, India minimized asset-liability currency mismatches and paved the way for the growth of its domestic sustainability-focused fixed-income asset management industry, supporting future green bond issuances.

According to market reports, there are indications that the upcoming sale of sovereign green bonds could be significantly larger, potentially reaching up to $3 billion. The planned issuance is expected to take place during the first half of the 2023–24 financial year.

India’s integration of green bonds into its decarbonization strategy is a landmark step towards a more sustainable future. By adhering to a well-structured green bond framework, India ensures that funding is directed towards projects with genuine environmental benefits, boosting investor confidence and driving progress in the fight against climate change. As the country moves forward with its green initiatives, sovereign green bonds will undoubtedly continue to play a crucial role in accelerating India’s transition to a greener and more sustainable economy.

References:

Framework for Sovereign Green Bonds Government of India

India Integrates Green Bonds Into Its Decarbonization Strategy

Announced in Budget 2022, debut green bond performs better than expected